2025 Oregon Kicker Credit. The oregon kids credit, created by the. Oregon’s massive kicker is spurring a fresh look at the state’s unique tax rebate law by dirk vanderhart ( opb ) dec.

Calculate your Kicker Tax Refund Oregon Tax News, Published on march 15, 2025. The oregon kids credit, created by the.

Oregon kicker Taxpayers set to get a 1.6 billion rebate next year, Instead of kicker checks, the surplus will be returned to taxpayers through a credit on their 2025 state personal income tax returns filed in 2025. Published on march 15, 2025.

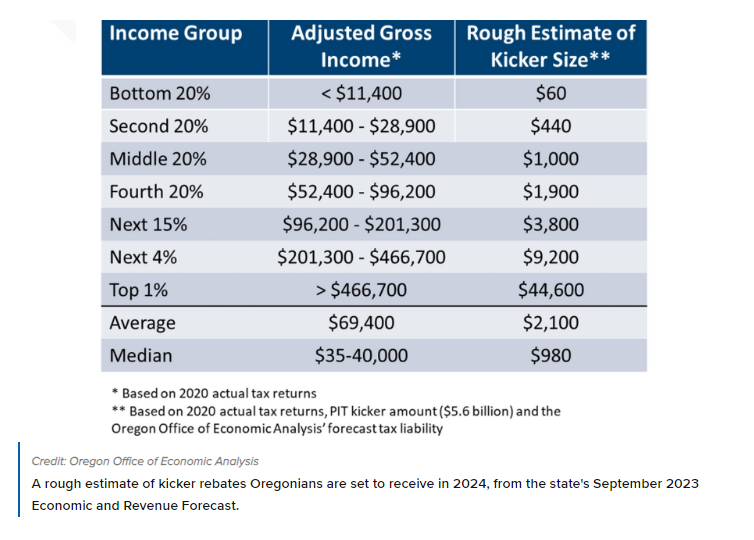

Oregon State Tax Kicker Calculator 2025 Elena Heather, For most taxpayers this will increase the amount of their refund or decrease. This year’s highly anticipated kicker tax credit will put $5.61.

10 for 10 Oregon Kicker Aidan Schneider Will Win Lou Groza Award, Jan 25, 2025 updated feb 16, 2025. Although there are minimal requirements.

Oregon's kicker explained What you need to know, Oregon’s newest tax credit could provide as much as a $5,000 boost to the budgets of the state’s lowest income families. 29, is the first day that oregon will begin processing electronically filed 2025 state income tax returns.

Big kicker credit coming to Oregon taxpayers, The kicker first estimated in may and again in august will be credited to taxpayers filing their 2025 state personal income tax in 2025. (ktvz) — oregon taxpayers have already claimed more than $1.6 billion of the record $5.61 billion surplus revenue kicker tax credit being returned to.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9139799/460026656.jpg)

Oregon ‘Kicker’ Credit Who Qualifies and What’s It Worth?, Looking forward to the 2025 tax season? Although there are minimal requirements.

2025 Oregon Tax Kicker Mair Sophie, The kicker will be returned to taxpayers as a credit on their 2025 tax returns filed in 2025. Instead of kicker checks, the surplus will be returned to taxpayers through a credit on their 2025 state personal income tax returns filed in 2025.

Oregon's 'kicker' tax, explained YouTube, Looking forward to the 2025 tax season? Oregon’s newest tax credit could provide as much as a $5,000 boost to the budgets of the state’s lowest income families.