Long Term Capital Gains Tax Rate 2025 Bracket. There are two main categories for capital gains: High income earners may be subject to an additional.

One of the most notable changes is the harmonization of tax rates. Capital gains exemption limit hiked, long term cap gains tax increased to 12.5% from 10%.

What Is The Long Term Capital Gains Tax 2025 Amii Lynsey, 2025 capital gains tax brackets. Exemption on ltcg has been increased from rs.1 lakh to rs.1.25 lakhs per annum.

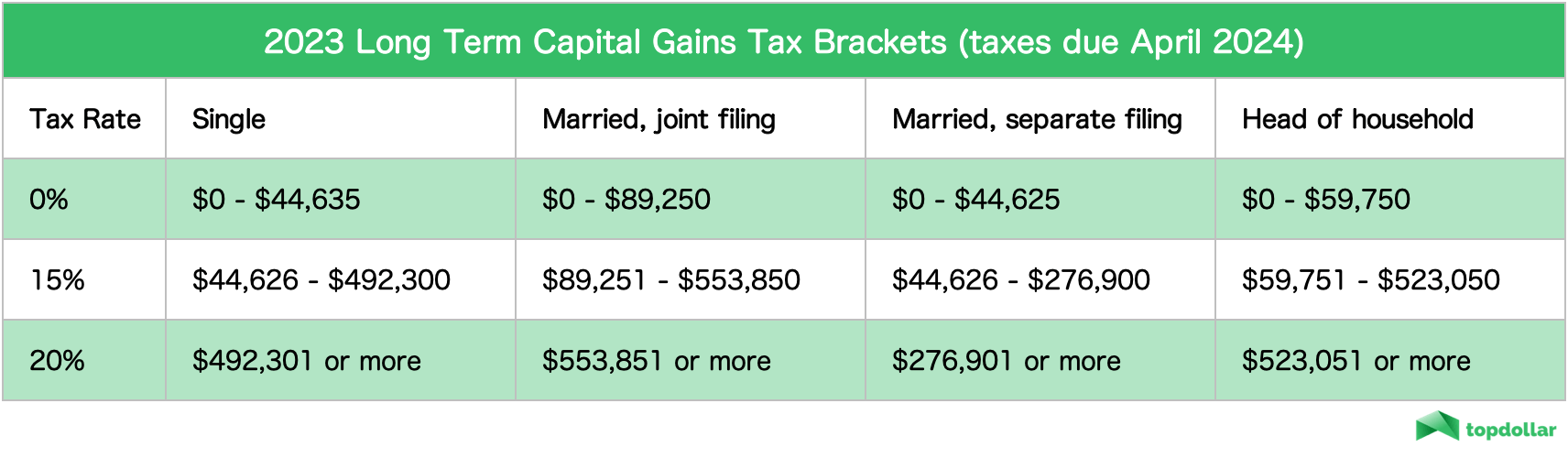

Capital Gains Tax Increase 2025 Hanny Kirstin, Don’t be afraid of going into the next tax bracket. If your taxable income exceeds those amounts, you may be subject to 15% and 20% tax rates.

Long Term Capital Gains Tax Brackets 2025 Gnni Malissa, The rate may be lower than what you. Single filers can qualify for the.

Long Term Capital Gains Tax Rate 2025 Bracket Mamie Rozanna, There are two main categories for capital gains: Single filers can qualify for the.

Capital Gains Rate 2025 Table Image to u, Exemption on ltcg has been increased from rs.1 lakh to rs.1.25 lakhs per annum. Here’s a breakdown of the 2025 capital gains tax brackets:

Capital Gains Tax Rate 2025 Overview and Calculation, Don’t be afraid of going into the next tax bracket. Capital gains exemption limit hiked, long term cap gains tax increased to 12.5% from 10%.

Long Term Capital Gains Tax Rate 2025 Nys Dita Myrtle, When your other taxable income (after deductions) plus your qualified dividends. One of the most notable changes is the harmonization of tax rates.

Long Term Capital Gains Tax Brackets 2025 Gnni Malissa, Here’s a look at the rates at. The union budget 2025 introduced significant modifications to the taxation of capital gains in india.

2025 Long Term Capital Gains Rates Alfie Kristy, While that on all other financial assets and all non. Capital gains exemption limit hiked, long term cap gains tax increased to 12.5% from 10%.

Irs 2025 Capital Gains Tax Brackets Hanni Kirsten, One of the most notable changes is the harmonization of tax rates. While that on all other financial assets and all non.